Digital Account Opening Solution

Faster onboarding for new accounts, digitally

Digital account opening empowers applicants to seamlessly open and fund a new account in three minutes or less via an intuitive application. Win the primary banking relationship and grow deposits by automatically registering and onboarding new account holders directly into your digital banking solution.

Execute on your growth strategy for retail & business accounts

Build lasting relationships with prospects via an intuitive digital account opening solution. Elevate your digital branch with mobile-first applications, real-time identity verification powered by Non-Documentary Customer Identification methods, and integrations to cultivate account holder relationships within digital banking.

Boost engagement with a digital storefront

Implement a digital account opening process that is simple and configurable for consumers and businesses.

Develop interest in checkings, savings, money market, and certificate of deposit accounts by providing informative product detail pages, branded to your FI. Cross-sell additional loans and credit cards based on the needs of the user.

Drive conversions with mobile-first onboarding

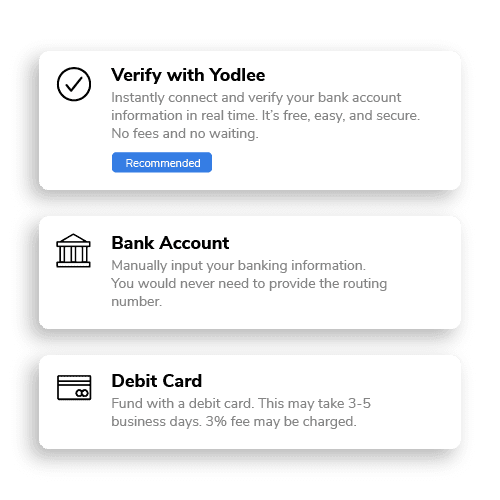

Increase conversion rates by removing barriers for users. Offer multiple funding options and streamline the process with bank account authentication or card-based funding.

With instant account verification, your FI can ensure compliance, enable applicants to initiate deposits in as little as seven seconds, and successfully capture funds.

Strengthen your operations & fight fraud

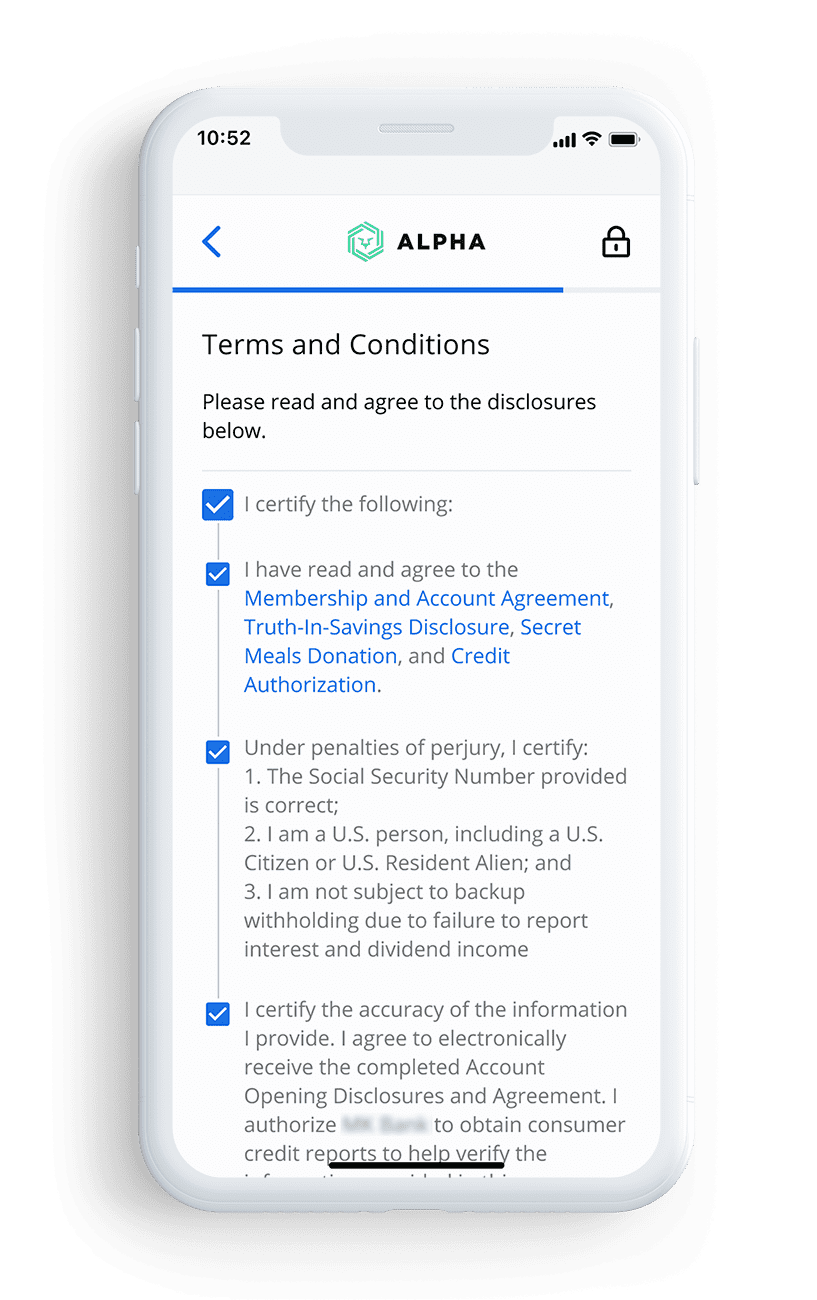

Opening a new account can be cumbersome for internal teams – between preparing account agreements, verifying identities, and boarding the account to the core.

Extend the benefit of online account origination beyond your account holders and into your back office. Create efficiencies with dynamic document generation and instant identity verification via a multi-layered approach.

Deploy real-time account creation for automated efficiency

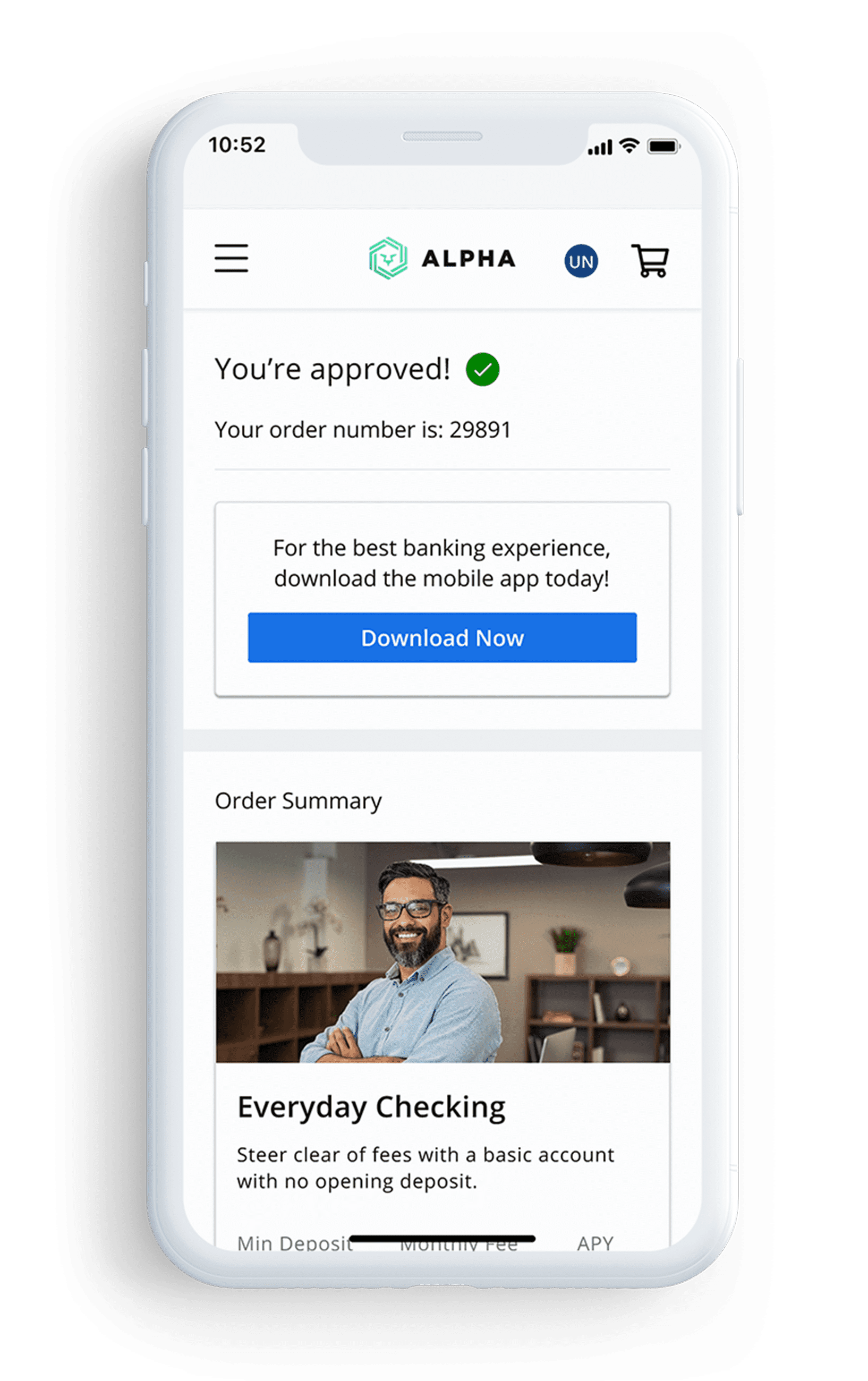

Reduce operational costs and friction by seamlessly transferring data from your application to the core. Looking to enhance your onboarding experience?

Once the account is opened, encourage the user to download your digital banking app and instantly register them without any manual entry. Welcome to a new era of growing banking relationships through everyday conveniences and personalized engagements.

Increase PFI status with existing account holders

Becoming users’ primary financial institution (PFI) is no small feat. It takes an enormous amount of effort to gain trust. Account holders have shown their loyalty to you, why not reward them with a superior user experience?

Empower existing users to effortlessly open a new account within digital banking via a streamlined application experience that only asks for signatures on agreements and funding.

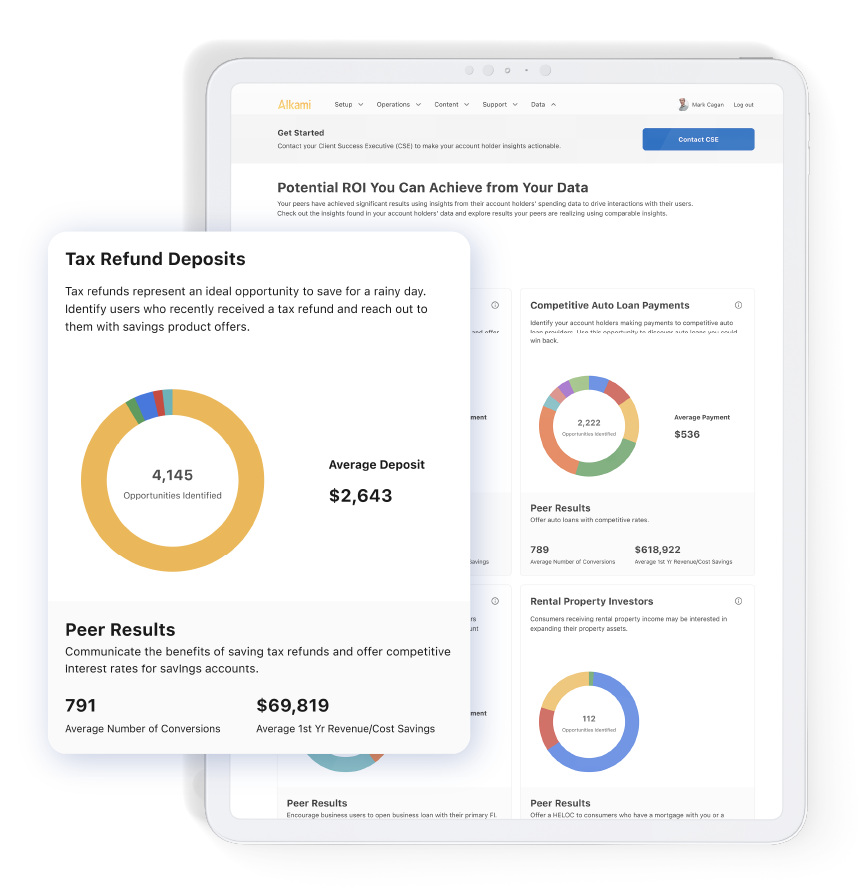

DATA ROI POTENTIAL DASHBOARD

Give users who receive tax refunds an easy way to save for a rainy day

Business Banking Solutions

Business Banking Solutions Data & Marketing Solutions

Data & Marketing Solutions Positive Pay & ACH Reporting

Positive Pay & ACH Reporting Who We Serve

Who We Serve